OTP Bank: summary of the first half 2024 results

published atAugust 12, 2024Tags:results

OTP Bank: summary of the first half 2024 results

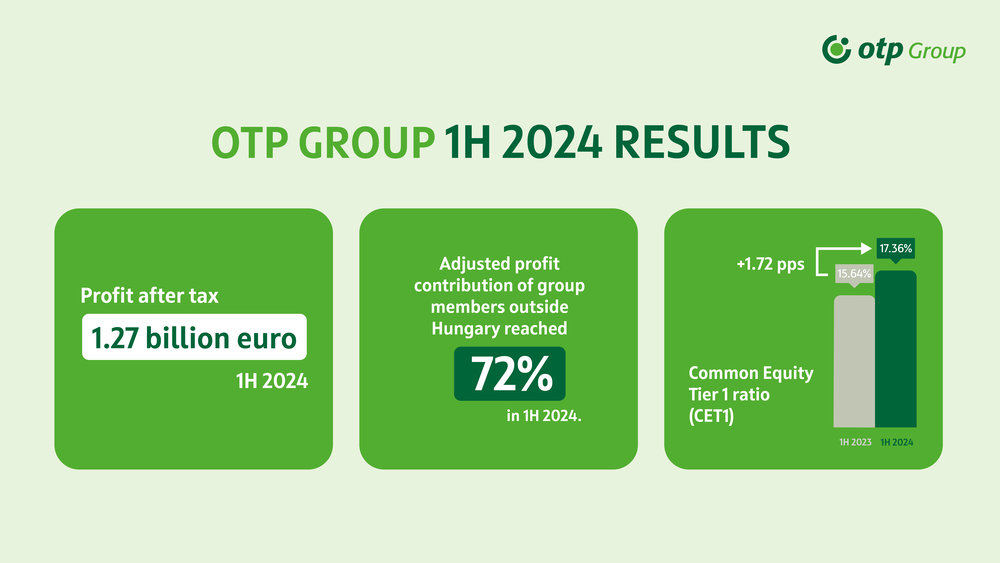

The Group’s semi-annual profit after tax reached EUR 1,3 billion, and the ROE indicator hit 23.6%.1

The 12% y-o-y profit decline was explained by the one-off direct effects of the inclusion of the two newly acquired banks in 1H 2023; in 1H 2024 no adjustment items occurred.

The half-year adjusted profit after tax increased by 28%, whereas the FX-adjusted growth without the on-going profit contribution of the two newly acquired banks reached 22%.

The semi-annual total risk costs increased by 83%, within that credit risk costs moderated by 25% due to the releases in 1Q 2024 in the OTP Core, Croatian, and Serbian segments, in the wake of improving forward-looking macro expectations. The jump in other risk costs in 2Q 2024 was caused by impairments made on Russian bonds.

The EUR 0,7 billion profit after tax realized in 2Q 2024 implied 12% q-o-q increase. In 2Q all group members reported positive results, and the adjusted profit contribution of group members outside Hungary reached 70%.

The q-o-q increase in profit was attributable to the EUR 75 million moderation on the corporate income tax line.

In 2Q the operating income grew 16% q-o-q, while total income advanced by 9%.

Operating costs went up by 1% q-o-q.

Consolidated performing (Stage 1+2) loans expanded by 3% q-o-q (FX-adjusted), thus the year-to-date growth reached 4%, and 5% without Romania. In the second quarter the pace of growth accelerated in Bulgaria, Croatia and Serbia, and exceeded the Group average.

Consolidated deposits expanded by 2% q-o-q and 3% year-to-date, on an FX-adjusted basis. The quarterly expansion was driven by household volumes.

1OTP’s reporting currency is in HUF. The EUR values shown in this summary were converted at the exchange rate provided by the National Bank of Hungary for the given periods; the P&L values were converted at the average of period rates; the performance indicators and changes were calculated from the HUF values.