Capital Market Activity

Funding strategy

Background

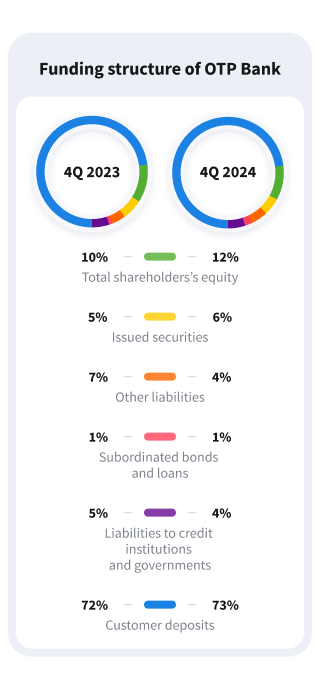

Traditionally, within OTP Group’s funding sources the customer deposit base has a significant role, primarily due to the strong positions reached by the Group on the Hungarian and Bulgarian deposit markets.

OTP Group put much emphasis on maintaining its strong customer deposit base. FX-adjusted performing (Stage 1 + Stage 2) loan portfolio increased by 4% in 4Q 2024 y-o-y, while deposit base increased by 2%. Due to joint effect of these factors the net loan-to-deposit ratio of the Group changed to 73.8%, it is 0.9 pp FX-adjusted increase on the yearly base. The capital position of the Group is stable with CET1 ratio standing at 18.9% at the end of 4Q 2024.

Funding Sources

OTP Group applies wide range of money market and capital market sources to cover the funding need of its domestic and foreign customer loans. The Group is active primarily on the local capital markets through OTP Bank and OTP Mortgage Bank by issuing several instruments with varying maturity, denomination and structure.

Through its EMTN Programme established in May 2020 and updated on a yearly basis, OTP Bank has a flexible tool to access to the international eurobond markets. Beyond the bond market instruments, from time-to-time OTP Bank uses syndicated and bilateral loans to diversify its funding structure. Out of the foreign subsidiary banks of the OTP Group, OTP banka Slovenia and Ipoteka Bank has outstanding international bonds.

Main components of the consolidated balance sheet (in HUF billion)

| 4Q 2024 | 4Q 2023 | |

|---|---|---|

| Liabilities to credit institutions and governments | 2 022 | 1 941 |

| Customer deposits | 31 658 | 28 332 |

| Issued securities | 2 593 | 2 096 |

| Other liabilities | 1 656 | 2 583 |

| Subordinated bonds and loans | 369 | 562 |

| Total shareholders' equity | 5 120 | 4 095 |

| Total liabilities and shareholders' equity | 43 419 | 39 609 |

4Q 2024

4Q 2023

- Liabilities to credit institutions and governments2 022

- Customer deposits31 658

- Issued securities2 593

- Other liabilities1 656

- Subordinated bonds and loans369

- Total shareholders' equity5 120

- Total liabilities and shareholders' equity43 419

- Liabilities to credit institutions and governments1 941

- Customer deposits28 332

- Issued securities2 096

- Other liabilities2 583

- Subordinated bonds and loans562

- Total shareholders' equity4 095

- Total liabilities and shareholders' equity39 609

Last update: 07/03/2025