OTP Bank: summary of the first nine months 2024 results

published atNovember 8, 2024Tags:results

OTP Bank: summary of the first nine months 2024 results

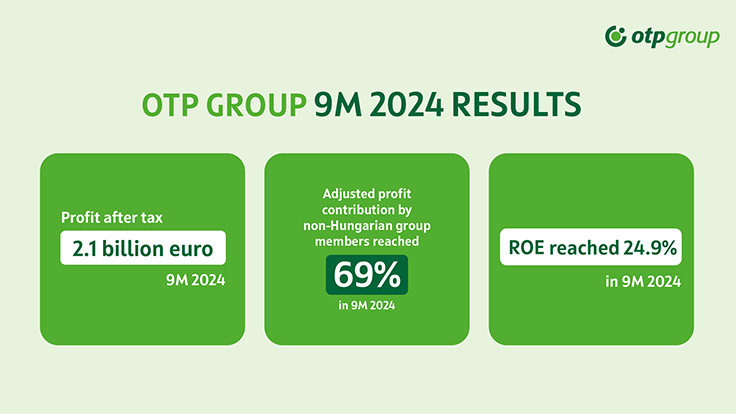

The Group’s cumulated profit after tax amounted to EUR 2,112 million in January-September 2024, with ROE reaching 24.9%. The 4% y-o-y decrease in the profit after tax was due to the EUR 425 million (after tax) one-off direct effect of the inclusion of the two newly acquired banks in the base period in contrast; in 9M 2024 no adjustment items occurred on group level.

In January-September 2024 all geographical

segments reported positive results. The share of foreign profit contribution

reached 69% after the consolidation of the newly acquired Ipoteka Bank in

Uzbekistan and the Romanian bank’s sale completed in July 2024.

Cumulated adjusted profit after tax improved by 19%1, whereas the organic2 and FX-adjusted growth was 14% y-o-y.

The cumulated operating profit increased by 22%, mainly driven by the 28% increase in net interest income (+25% organically and FX-adjusted), boosted by both expanding business volumes and improving margins.

Operating costs went up by 14%, while the organic and FX-adjusted cost growth hit 13%. The cumulated cost to income ratio improved by 1.7 pps to 41.0%.

The EUR 814 million profit after tax realized in the third quarter of 2024 was consistent with 19% or EUR 129 million q-o-q increase, driven mainly by the EUR 54 million higher other income and the EUR 49 million decrease in impairment charges.

In 3Q operating income grew 7% q-o-q, while it posted 6% growth organically and FX-adjusted.

Consolidated credit quality remained stable, main credit quality indicators continued to develop favourably.

Consolidated deposits expanded by 2% q-o-q without the effect of the deconsolidation of Romania and FX-adjusted, culminating in 5% ytd growth.

1As the amounts are expressed in euros, the dynamics of the changes are expressed in forints, therefore the percentage values may be distorted by exchange rate changes.

2Regarding the y-o-y changes in the different P&L lines in the first nine months, organic growth is defined as follows: without the contribution of Ipoteka Bank (consolidated from July 2023) and the Romanian bank sold in July 2024, and without the EUR 26.8 million one-off gain presented on the other income line in 3Q 2024 in the wake of the deconsolidation of Romania. Regarding the q-o-q changes in the different P&L lines in 3Q 2024, organic growth is defined as follows: without the contribution the Romanian bank sold in July 2024, and without the 26.8 million one-off gain presented on the other income line in 3Q 2024 in the wake of the deconsolidation of Romania.